23. September 2024 By Lisa Hütterroth

How insurers will reach the next level of customer activation in 2025

Four ideas for more visitors to your website

The last few years have seen the emergence of many new tools and processes related to customer activation and artificial intelligence, shaking up the marketing and CRM landscape. No meetup or conference can do without the latest topics such as customer centricity, AI-based next best action or 360-degree customer view. Many concepts have been developed and projects launched. There is hardly an insurer that does not place customers at the centre of its future developments and strategies.

However, the challenges remain: How do I get my contacts and customers to my website in the future? How do I activate them for my new sales approach? How do I approach upselling and cross-selling in the future?

We have therefore collected some food for thought that could generate more activity among contacts and customers in 2025:

Approach 1 - Hyper-personalisation and life events

More relevance in the Customer Centricity Strategy 2025

A customer-oriented corporate strategy, known as customer centricity, has been an issue for many insurers for some time. Some have already celebrated success with individualised, customer-centric customer journeys.

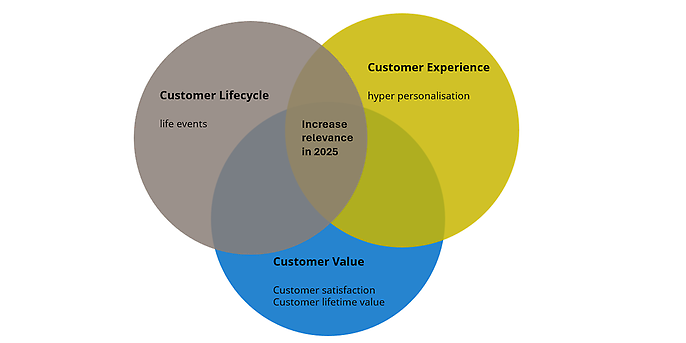

The three pillars of customer centricity are a customer-oriented customer lifecycle, a customer experience developed with and for customers, and tangible customer value.

From personalisation to hyperpersonalisation

The customer experience, i.e. the ideally positive experience of customers with the provider, can be further improved in 2025. Hyper-personalisation in advertising media, campaigns and also in customer service can offer customers a new level of fulfilment of their needs and addressing of their pain points.

The personalisation that has been frequently used up to now was based on historical, known data. Hyper-personalisation makes use of artificial intelligence to generate a prediction.

For example, real-time usage data from an online sales process is combined with other data sources, such as weather data or a personal profile, to generate a personal recommendation for a residential building tariff or a special questionnaire to provide assistance.

You can find out more about hyper-personalisation in the blog post Customer Engagement – ‘Hyper-personalisation’ in the insurance industry.

Key life events for more relevant customer activation

The customer lifecycle can also be optimised in the future. With the help of key life events, i.e. the life events of customers, and provided that data protection requirements are met, both the relevance of the point in time at which the customer is addressed and the hyper-personalisation of content in sales and service can be optimised, thus activating customers.

These two measures increase customer value, i.e. the value that customers represent for the company. This is because a customer who is addressed with a more relevant message is more likely to interact with the offer and buy. This forms the basis for a better customer satisfaction score, higher customer lifetime value and increasing customer activity.

For more information, read the blog post Data-driven Insurance - Data Culture and Data-driven Mindset.

Approach 2 - Accessibility for everyone

Clear advertising communication

The European Accessibility Act (the Accessibility Strengthening Act), which makes accessibility for products and services mandatory by law, will apply from 2025 and sets out the criteria according to which providers must design technical accessibility for their offers, such as online trading, online banking or even online insurance. This includes the operation of the application, for example a website, as well as the presentation of the content.

The barrier-free and simple presentation of content, including through high contrasts in the choice of colours and simple language, is an opportunity to attract more customers to the website with little effort. Because now you have the opportunity to specifically check your marketing and sales communication for comprehension, in addition to your online presence.

How well is my communication received?

- 1. Do my texts really address the needs of my customers?

- 2. Are my texts formulated simply enough to be easy to understand and to the point?

- 3. Do my images support my message?

- 4. Are my emails well structured and also readable by screen readers? Is the font size large enough, and is there enough space between lines and paragraphs? Are images, icons and logos provided with alternative texts?

- 5. Is the information architecture simply structured and useful from the customer's point of view?

Data-driven customer communication

One effective and data-driven way to check updated communication is to use qualitative and quantitative user tests. Survey focus groups or conduct targeted moderated user tests. This will give you deep insights into the reception and effectiveness of your communication. In addition, surveys are recommended to be able to check the results quantitatively.

You can find more information in the blog post User Research: How user research increases your conversions.

One thing is certain: the Accessibility Improvement Act is an opportunity for more targeted communication and thus more customers on your website in 2025!

Approach 3 - Give your customers a nudge

Actively engaging your customers

Digital nudging? The keyword may not be well known, but everyone has certainly already been digitally nudged at some point. Nudges are small digital ‘pushes’ or psychological triggers designed to help users make decisions without patronising or manipulating them. The nudge theory of Richard Thaler and Cass Sunstein deals with nudges to encourage schoolchildren to eat healthier food or to prevent procrastination when it comes to retirement planning, for example.

Psychological triggers are, for example, consciously set anchors in communication. This could be a classification of the costs of an insurance tariff that is now offered at a lower price than the previous generation of tariffs. Open communication about this helps interested parties to understand the current price and thus ‘anchor’ it. Another well-known example is displaying certifications on the website to strengthen trust in the brand or showing recommendations and reviews from existing customers.

Use nudges for sustainable everyday life

Digital nudging can help motivate your customers to visit your website and increase customer satisfaction in the long term. This is the case with adesso's project with Zurich Versicherung: an app with small daily ‘nudges’ helps customers to make their everyday lives more sustainable and thus to make better decisions.

You can find more information about this project in our press release.

Approach 4 – customer feedback increases customer activity

The customers know best

The relevance of systematic, qualitative customer satisfaction surveys is well known. Frameworks such as the Net Promoter Score (NPS) or Customer Satisfaction (CSAT) are popular because, in addition to asking for a satisfaction score, they also give the evaluators the option of an open, qualitative assessment.

The calculated score is helpful for measuring the development and effectiveness of customer satisfaction and loyalty. However, the open feedback from customers is invaluable because it addresses the ‘why’, namely the reason for the customer's numerical rating. This open text feedback (also from other sources) can be easily clustered into positive/negative or product categories, or analysed in detail. Particularly helpful is sentiment analysis, which, in addition to the content of a text, also evaluates mood and emotional tone.

This constant feedback on your own offering opens up the opportunity to address the right pain points of your customers and thus ensure higher customer activity.

Understanding customer feedback correctly with LLMs

The next level is the use of Large Language Models (LLMs) and Generative AI (GenAI). This is because LLMs not only make it possible to cluster the keywords and phrases of the feedback, but also to delve into a deeper content analysis using AI: What are customers saying about the new tariff? How do they feel about it?

What fears or concerns do they have when they see the new offer?

Generative artificial intelligence makes it possible to analyse the detailed feedback in real time and to react to it immediately.

You can find more information about Large Language Models here.

For example, a user is on an online tariff-conclusion page and has been on the tariff selection page for some time. The user is asked about their customer satisfaction by a widget. The score is in the mid-range, and the comment is short. With the help of GenAI, the user can then be offered proactive support directly through a chatbot or a call from a sales representative. The customer's questions are answered and he can continue with the tariff agreement.

So use your customer feedback not only to show customer satisfaction, but also to continuously improve the product experience and activity on the website.

Conclusion

There is great potential for optimising customer activity. Based on newly acquired data, new ideas can be derived from each measure, inspiring old and new customers and attracting them to the website.

Before tackling new measures in 2025, you should ask yourself whether you are already getting the customer activity you originally targeted out of the current setup. If not, it is worth questioning the measures and checking whether a new level of data quality, transparent communication and meaningful use of the customer feedback currently collected is happening.

And don't forget: the customers are the focus – even in 2025!

Would you like to learn more about exciting topics from the adesso world? Then take a look at our latest blog posts.

Also interesting

Customer centricity in insurance

adesso's customer centricity strategy helps you provide personalised services, seamless customer journeys and consistent support across all channels. This is where modern technologies such as artificial intelligence come into play to optimise processes and retain customers in the long term.